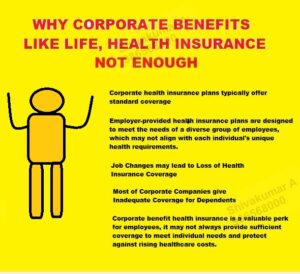

Why Employer or Corporate Insurance Might Not Be Enough: Understanding Its Limitations

For many employees, the offer of corporate insurance coverage by their employer can seem like a valuable perk. After all, it provides a safety net for medical emergencies and other unforeseen events. However, relying solely on employer-provided insurance may not always be the best option. Here’s why:

Limited Coverage Options

Employer corporate insurance plans often come with limited coverage options. While they may cover basic medical expenses, such as hospitalization and doctor visits, they may not offer the comprehensive coverage needed for specific health conditions or treatments. Employees with unique medical needs may find themselves underinsured or facing significant out-of-pocket expenses.

Lack of Customization

Corporate insurance plans are designed to meet the needs of a diverse workforce, which means they may not be tailored to individual requirements. Employees may find themselves paying for coverage they don’t need while lacking coverage for services that are essential to them. This lack of customization can lead to inefficiencies and dissatisfaction with the insurance plan.

Portability Issues

One of the major drawbacks of employer-provided insurance is its lack of portability. When employees leave their job or retire, they often lose access to their employer-sponsored insurance benefits. This can leave them vulnerable during periods of transition, especially if they have pre-existing health conditions or require ongoing medical treatment. Portability issues can also arise if an employee needs to relocate to a different city or country.

Limited Choice of Providers

Employer corporate insurance plans typically come with a limited network of healthcare providers. While this may not be a problem for routine medical care, it can become a significant issue if employees need specialized treatment or prefer to see a specific doctor or hospital. Limited choice of providers can lead to delays in accessing care or dissatisfaction with the quality of services received.

Dependency on Employer

Relying solely on employer-provided insurance can create a sense of dependency on the employer for healthcare coverage. Employees may feel hesitant to leave their job or explore other career opportunities due to concerns about losing their insurance benefits. This lack of mobility can hinder professional growth and limit employees’ ability to pursue their career goals.

Conclusion

While employer corporate insurance can offer valuable coverage, it’s essential for employees to understand its limitations. By being aware of the potential drawbacks of relying solely on employer-provided insurance, individuals can make more informed decisions about their healthcare coverage. Exploring additional insurance options, such as individual health insurance plans or supplemental coverage, can provide greater flexibility and peace of mind for employees and their families.