Should I invest in a life insurance plan by LIC of India?

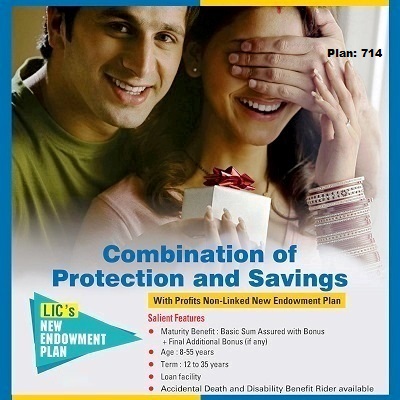

Investing in an endowment plan offered by the Life Insurance Corporation (LIC) of India can be a wise decision depending on your financial goals, risk appetite, and long-term requirements. Endowment plans are a hybrid product that combines insurance with savings, providing financial security and a corpus at maturity. With our experience we would try to give a detailed exploration of the factors you should consider in determining if investing in an LIC endowment plan is the right choice for you.

What Are Endowment Plans?

Endowment plans are life insurance policies that pay a lump sum amount either upon the policyholder’s death or at the maturity of the policy, whichever occurs first. Over the year, the structure of the endowment plans have changed. From giving one-time maturity benefits, recent changes seems to be much favorable to the investor. LIC’s endowment plans are structured to provide dual benefits:

Insurance Coverage:

Ensures financial security for your family in case of your untimely demise. Endowment plans help to build a disciplined savings habit, yielding a lump sum payout at the end of the policy term.

Benefits of LIC Endowment Plans

Guaranteed Returns: LIC endowment plans generally provide guaranteed returns through bonuses and loyalty additions, making them suitable for risk-averse investors. The maturity amount includes the sum assured, accrued bonuses, and additional benefits, ensuring a safety net.

Life Coverage: The plans offer life insurance coverage throughout the policy term, ensuring your loved ones are financially secure even in your absence.Tax Benefits: Premiums paid are eligible for tax deductions under Section 80C of the Income Tax Act, 1961. Additionally, the maturity proceeds are tax-exempt under Section 10(10D), subject to conditions.

Life Coverage: The plans offer life insurance coverage throughout the policy term, ensuring your loved ones are financially secure even in your absence.Tax Benefits: Premiums paid are eligible for tax deductions under Section 80C of the Income Tax Act, 1961. Additionally, the maturity proceeds are tax-exempt under Section 10(10D), subject to conditions.

Disciplined Savings: Endowment plans encourage regular savings, helping you build a substantial corpus over time for long-term goals like retirement, education, or purchasing property.

Low-Risk Investment: LIC, backed by government assurance, is a trusted name, making its endowment plans a low-risk investment option compared to equity markets.

Drawbacks of LIC Endowment Plans

Lower Returns Compared to Market-Linked Investments: The returns on LIC endowment plans are modest, often lower than investments in mutual funds or equities. This is because a significant portion of your premium is allocated toward life insurance coverage, reducing the savings component.

Illiquidity: Endowment plans require long-term commitment, and premature withdrawals or surrenders attract penalties and reduced payouts.

High Premiums: These plans usually demand higher premiums compared to term insurance policies for the same level of life cover, making them less cost-effective for pure protection purposes.

Lack of Flexibility: Endowment plans have fixed premiums and tenure, limiting your ability to adjust contributions or policy terms as per changing financial circumstances.

When Should You Consider LIC Endowment Plans?

Investing in an LIC endowment plan may be suitable if:

Risk-Averse: You prefer guaranteed returns over the potential volatility of market-linked investments.

Long-Term Goals: You aim to save for a long-term objective, such as a child’s education or retirement.

Life Coverage and Savings: You seek a product that combines insurance with savings.

Tax Efficiency: You wish to avail tax benefits while ensuring disciplined financial planning.

Other alternatives considering today’s changes try:

Term Insurance + Mutual Funds: Accepting changes, start term insurance for high life coverage at low premiums and invest the remaining amount in mutual funds for potentially higher returns.

Public Provident Fund (PPF): Offers tax-free returns and long-term savings with government backing. But considering the recent Mutual funds and tax-saving mutual funds, PPF returns are very low.

ULIPs: Unit-Linked Insurance Plans combine insurance and investment with exposure to equities, offering potentially higher returns. Consider keeping insurance separate from the investments.

Considering India’s middle-class population, LIC endowment plans are ideal for individuals seeking a low-risk, long-term investment option with insurance coverage and guaranteed returns. However, their relatively low returns, lack of flexibility, and higher premiums might not appeal to everyone. Before investing, assess your financial goals, risk tolerance, and the need for liquidity. Comparing endowment plans with alternative products like mutual funds, PPF, or ULIPs can help you make a more informed decision.