Buy LIC Policy Rs. 1000/- per month

Secure Your Family’s Future with LIC Life Insurance Policy

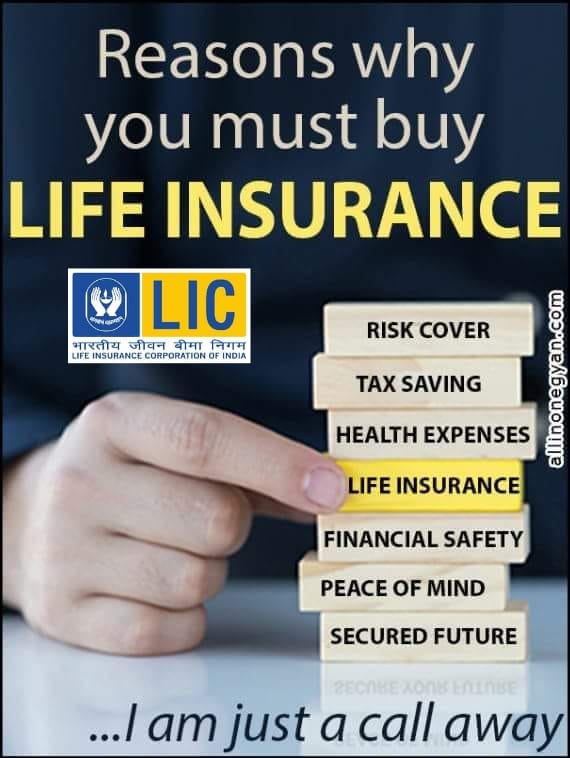

Life is unpredictable, but your family’s financial security shouldn’t be. With LIC’s life insurance policy, you can ensure that your loved ones are protected even when you’re not around. And the best part? You can get this peace of mind for just Rs. 1000 per month.

LIC plans are designed for every life event, like childbirth, child education, marriage, life insurance, health insurance, LIC pure term insurance, pension plans, senior citizen plans, and fixed income plans.

Why Choose LIC?

LIC (Life Insurance Corporation of India) has been a trusted name in insurance for decades. With a strong reputation for reliability and financial stability, LIC offers a range of insurance products tailored to meet the diverse needs of its customers.

LIC of India is the only life insurance company in India to have a sovereign guarantee from the Government of India.

Buy LIC Policy Rs. 1000/- per month

Key Benefits of LIC Life Insurance Policy:

Financial Security: In the event of your untimely demise, your family will receive a lump sum amount, ensuring they can continue their lives without financial strain.

Flexible Premium: For just Rs. 1000 per month, you can secure your family’s future. This affordable premium makes it easier for individuals from various income brackets to obtain coverage.

Tax Benefits: Additionally, LIC life insurance policies offer tax benefits under Section 80C of the Income Tax Act, allowing you to save on taxes while securing your family’s future.

Loan Facility: You can avail of a loan against your LIC policy in times of need, providing you with financial flexibility when required.

Bonus Additions: Depending on the policy you choose, LIC offers bonus additions, increasing the value of your policy over time.

How to Get Started:

Getting started with LIC’s life insurance policy is easy. Simply reach out to your nearest LIC branch or licensed agent to discuss your requirements. They will guide you through the process, helping you choose the policy that best suits your needs and budget.

Buy LIC Policy Rs. 1000/- per month or for more as per your budget. Don’t leave your family’s future to change. With LIC’s life insurance policy, you can ensure that they are financially protected, no matter what the future holds. And with a monthly premium of just Rs. 1000, it’s a small price to pay for priceless peace of mind. Please read the policy document carefully before investing.

Insurance is the subject of solicitation.