LIC India

LIC India, the Life Insurance Corporation of India (LIC), established in 1956, stands as a stalwart in the Indian insurance landscape, offering a wide array of insurance products and financial services. As one of the largest insurance companies in the world, LIC’s sheer scale and reach are awe-inspiring. Let’s delve into the intricacies of its size, network, policies, customer base, and the trust it garners from policyholders.

Size and Network:

LIC boasts an extensive network of branches spread across the length and breadth of India. As of the latest available data, Life Insurance Corporation functions with 2048 fully computerized branch offices, 113 divisional offices, 8 zonal offices, 1381 satellite offices, and the corporate office. Life Insurance Corporation’s Wide Area Network covers 113 divisional offices and connects all the branches through a Metro Area Network. Life Insurance Corporation has tied up with some Banks and Service providers to offer on-line premium collection facility in selected cities.

LIC Agents Premium collection centers spread across the country, also work like LIC mini offices and help customers pay the premium on time. Life Insurance Corporation’s ECS and ATM premium payment facility is an addition to customer convenience. Apart from on-line Kiosks and IVRS, information centers have been commissioned at Mumbai, Ahmedabad, Bangalore, Chennai, Hyderabad, Kolkata, New Delhi, Pune and many other cities. With a vision of providing easy access to its policyholders, Life Insurance Corporation has launched its Satellite SAMPARK offices. The satellite offices are smaller, leaner, and closer to the customer.

This expansive presence ensures accessibility to insurance services even in the remotest corners of the country.

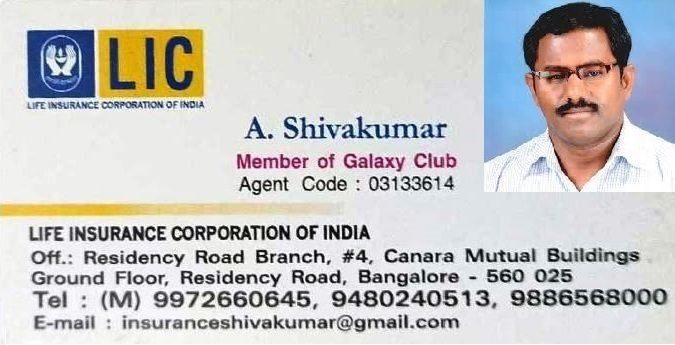

Agent Force:

A significant factor contributing to LIC’s reach is its vast army of agents. These dedicated individuals serve as the face of LIC, bringing insurance solutions directly to customers’ doorsteps. The exact count of LIC agents stands at [number of agents], making it one of the largest agency forces in the world.

Diverse Policies:

LIC offers a diverse portfolio of insurance products catering to varying needs and preferences. From traditional endowment plans to unit-linked insurance plans (ULIPs), LIC has something for everyone. LIC popular plans include child education plans, pure term insurance, whole life policies, pension plans, fixed income plans, and more. This comprehensive range ensures that customers can find suitable coverage tailored to their requirements.

Customer Base:

The strength of LIC lies in its massive customer base, which comprises individuals from all walks of life. With millions of policyholders trusting LIC with their financial well-being, it holds a significant market share in the Indian insurance sector. This broad customer base reflects the widespread faith and confidence in LIC’s reliability and stability.

Global Ranking:

LIC’s stature extends beyond national borders, earning it a place among the largest insurance companies globally. In terms of total assets under management (AUM) and premium income, LIC consistently ranks [insert global ranking] among insurance giants worldwide. This international recognition underscores LIC’s formidable presence on the global stage.

Claims Paid Percentage:

A crucial metric reflecting an insurer’s commitment to its policyholders is the claims-paid percentage. LIC takes pride in its exemplary track record of honouring claims promptly and efficiently. With a claims settlement ratio of [percentage], LIC demonstrates its unwavering dedication to fulfilling its obligations towards policyholders, providing them with much-needed financial security during challenging times.

Trust and Credibility:

Perhaps the most significant testament to LIC’s standing in the insurance industry is the trust it commands from policyholders. Over the decades, LIC has built a legacy of reliability, transparency, and customer-centricity. Its steadfast adherence to ethical practices and stringent governance standards has earned it the unwavering trust of millions of Indians. For many, LIC is not just an insurance provider but a symbol of assurance and stability.

In conclusion, the magnitude of LIC’s presence in the Indian insurance landscape is unparalleled. With its vast network, diverse product offerings, massive customer base, and unwavering commitment to customer satisfaction, LIC continues to be a beacon of trust and reliability in the financial services sector. As it strides confidently into the future, LIC remains poised to uphold its legacy while embracing innovation and evolution to meet the evolving needs of its policyholders.