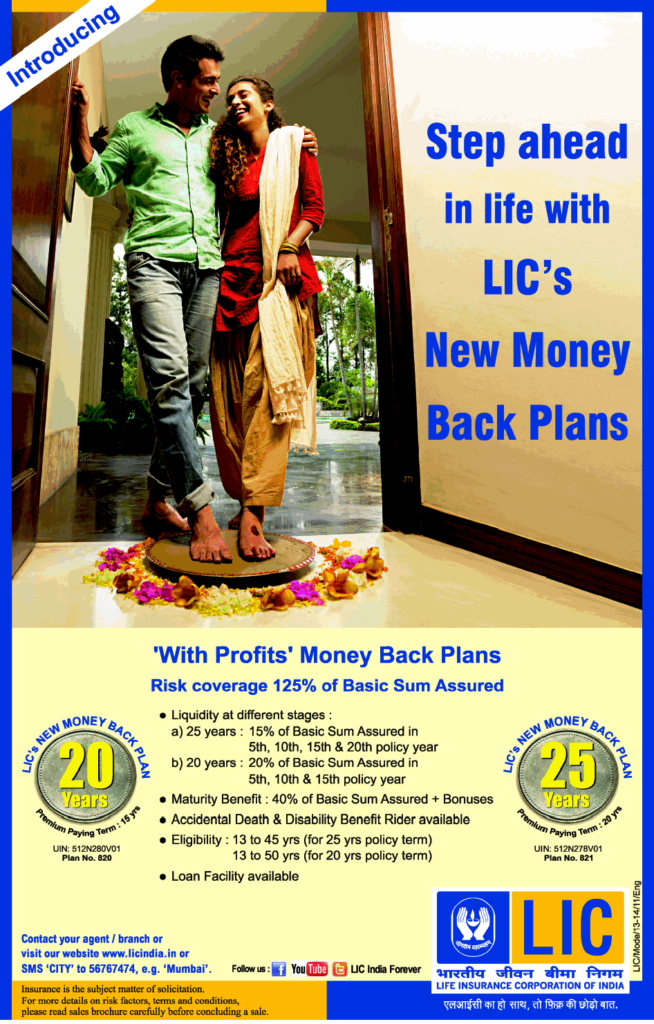

LIC Money-Back Plans

Life Insurance Corporation of India (LIC) offers a range of money back plans that are tailored to meet the financial needs of diverse groups, including salaried employees and businessmen. Among the various offerings, the 20-year and 25-year Money Back Plans are particularly popular. These plans not only provide life cover but also offer periodic returns, which can be very useful for managing near-term expenses like celebrating milestones, handling emergencies, or paying school fees. Additionally, the tax-free return aspect of these plans adds to their allure, making them a prudent choice for anyone looking to combine insurance with investment.

Overview of LIC Money Back Plans:

LIC’s Money Back Plans are designed to disburse a portion of the sum assured at regular intervals. This feature is what sets them apart from pure term or endowment plans, providing liquidity at key intervals throughout the tenure of the policy.

1. LIC 20-Year Money Back Plan:

This plan is structured to provide financial support for various needs over two decades. It’s particularly suited for salaried individuals who need periodic payouts to align with life’s significant expenses.

Features and Benefits:

- Survival Benefits: Pays 20% of the sum assured at the end of the 5th, 10th, and 15th years.

- Maturity Benefit: The remaining 40% of the sum assured, along with accrued bonuses, is paid at the end of the 20th year.

- Death Benefit: If the policyholder dies during the policy term, the full sum assured along with bonuses is payable, irrespective of the survival benefits already paid.

- Tax Benefits: Premiums paid are eligible for deduction under Section 80C, and the maturity benefits are tax-free under Section 10(10D) of the Income Tax Act.

-

Eligibility conditions for LIC New Money Back Plan: 20 Years

- Sum Assured Minimum: Rs. 1,00,000, in multiples of Rs. 5000, & no limit on the maximum

- The policy term is 20 Years

- The premium Term is 15 Years

- Entry Age of Life Insured: Minimum 13 Years & Maximum 50 Years

- Age at Maturity: Maximum 70 Years

- Payment modes are Yearly, half-yearly, Quarterly or Monthly

2. LIC 25-Year Money Back Plan:

Aimed at individuals who are looking for long-term financial planning, the 25-Year Money Back Plan ensures that financial assistance is available at different stages of life, making it suitable for both salaried individuals and businessmen.

Features and Benefits:

- Survival Benefits: Pays 15% of the sum assured at the end of 5th, 10th, 15th, and 20th year.

- Maturity Benefit: The remaining 40% of the sum assured plus bonuses are paid at the end of the 25th year.

- Death Benefit: Full sum assured plus bonuses is payable on the death of the policyholder, regardless of earlier survival benefits.

- Tax Benefits: The premiums and returns are tax-free under Sections 80C and 10 (10D) respectively.

-

Eligibility conditions for LIC New Money Back Plan – 25 Years

- Sum Assured minimum: Rs. 1,00,000, in multiples of Rs. 5000, & no upper limit

- The policy term is 25 Years

- The premium Term is 20 Years

- Entry Age of Life Insured: Minimum 13 Years & Maximum 45 Years

- Age at Maturity: Maximum 70 Years

- Payment modes are Yearly, half-yearly, Quarterly or Monthly

Best Suited for Celebrations and Small Expenses:

One of the most significant advantages of LIC’s money-back plans is their ability to fund small yet important financial requirements at regular intervals. For instance, the money received can be used for:

- Celebrating milestones: Whether it’s a marriage, anniversary, or a significant birthday, the payouts can help cover the costs without impacting your savings.

- Handling emergencies: Unexpected expenses such as medical emergencies can be managed using the survival benefits.

- Education expenses: The payouts can coincide with major educational milestones, providing funds for school fees or college tuition.

Ideal for Salaried and Businessmen:

For Salaried Individuals: These plans act as a financial cushion that aligns well with their career growth and salary increments. The periodic payouts can supplement their income at crucial times, helping them plan their finances better without relying solely on savings or loans.

For Businessmen: The flexibility of getting periodic funds helps in managing cash flow, especially during periods of uneven earnings. Furthermore, the lump sum received at maturity can be reinvested into the business for expansion or other purposes.

Tax Efficiency:

A crucial aspect of LIC’s Money Back Plans is the tax efficiency they offer. The premiums paid towards the policy are deductible under Section 80C of the Income Tax Act, which can significantly reduce the taxable income of an individual. Moreover, the policy benefits, including the survival benefits and the maturity payout, are exempt from tax under Section 10(10D), provided the premium does not exceed 10% of the sum assured. This makes these plans not only a tool for financial security but also an efficient tax planning instrument.

The best option for periodic returns in between the terms is the LIC Money Back Plan. LIC’s 20-year and 25-year Money Back Plans are an excellent choice for individuals who are looking for a financial product that offers both protection and periodic payouts. These plans cater to the needs of both salaried individuals and businessmen by providing financial support during crucial phases of life, aiding in managing celebrations, small expenses, and even educational fees with ease. Additionally, the tax benefits associated with these plans make them an attractive option for efficient tax planning. Therefore, incorporating these money back plans into one’s financial portfolio can lead to balanced, risk-averse, and fruitful financial.