Mutual Funds

Open a lifetime free Account and start your SIP

People are confused between mutual funds and stocks. The term SIP is nothing but a way of investing. There are two ways to invest in mutual funds. They are, investing systematically, which is called an SIP (Systematic Investment Plan), and lump sum investments, which are also called fresh or one-time investments.

Mutual Fund Systematic Investment Plans (SIPs) have gained immense popularity among investors due to their simplicity, affordability, and potential for wealth creation. In this comprehensive guide, we will delve into the basics of mutual fund SIPs, their categories, and how they can help beat inflation while offering superior returns compared to traditional bank interest rates through the power of compounding.

The real growth can be tasted by investing systematically in sips. The one-time investment is good, but not recommended by many. The other way of investing is STP, a Systematic Transfer Plan. The STP is a mix of One-time investment and investing through Sips.

1. What is a mutual fund SIP?

A mutual funds SIP is a disciplined investment approach that allows investors to contribute a fixed amount regularly into a mutual fund scheme of their choice. These contributions are pooled with those of other investors and invested across a diversified portfolio of stocks, bonds, or other assets by professional fund managers.

2. Categories of Mutual Funds (SIP):

Mutual Funds SIPs are categorized based on various parameters such as investment objective, asset class, risk profile, and investment horizon. Some common categories include:

- Equity Funds: These funds primarily invest in the stocks of companies across sectors and market capitalizations, aiming for capital appreciation over the long term.

- Debt Funds: These funds predominantly invest in fixed-income securities such as government bonds, corporate bonds, and money market instruments, aiming for stable returns with lower risk.

- Hybrid Funds: Also known as balanced funds, these funds invest in a mix of equity and debt instruments to provide a balanced portfolio with potentially higher returns than pure debt funds and lower risk than pure equity funds.

- Index Funds: These funds passively track a specific market index, such as the Nifty 50 or Sensex, and aim to replicate its performance.

- Sectoral Funds: These funds focus on specific sectors or industries such as banking, IT, or healthcare, allowing investors to take concentrated bets on particular sectors.

- Tax-saving Funds (ELSS): Equity-linked savings schemes (ELSS) offer tax benefits under Section 80C of the Income Tax Act, making them popular among investors seeking tax savings along with wealth creation.

3. Beating Inflation and Wealth Creation:

One of the primary advantages of Mutual Funds SIPs is their potential to beat inflation and generate superior returns over the long term. Here’s how SIPs help in wealth creation and beating inflation:

- Diversification: Mutual Funds SIPs invest across a diversified portfolio of assets, reducing the risk of loss associated with investing in individual securities.

- Professional Management: SIPs are managed by experienced fund managers who conduct in-depth research and analysis to identify investment opportunities and optimize returns.

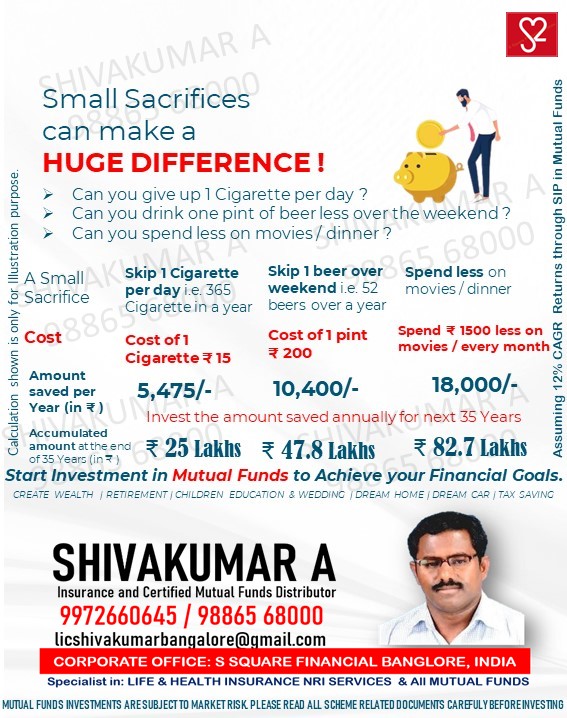

- Compounding: The power of compounding is a key driver of wealth creation in Mutual Funds SIPs. By reinvesting the returns generated from investments, compounding allows investors to earn returns not only on their initial investment but also on the returns generated over time.

- Rupee Cost Averaging: SIPs follow a rupee-cost averaging approach, where investors buy more units when prices are low and fewer units when prices are high. This helps in reducing the average cost per unit over time and mitigating the impact of market volatility.

- Long-term Horizon: SIPs are ideally suited for long-term wealth creation goals such as retirement planning, children’s education, or buying a house. By staying invested for the long term, investors can benefit from the power of compounding and ride out market fluctuations.

4. Beating Bank Interest Rates:

In today’s low-interest-rate environment, traditional bank deposits offer minimal returns, often failing to keep pace with inflation. Mutual Funds SIPs offer a compelling alternative by potentially generating higher returns over the long term. Here’s how SIPs can beat bank interest rates:

- Higher Return Potential: Equity-oriented Mutual Funds SIPs have historically delivered higher returns compared to bank deposits over the long term. While past performance is not indicative of future results, equities have historically outperformed fixed-income investments over extended periods.

- Tax Efficiency: Equity Mutual Funds held for more than one year qualify for long-term capital gains tax at a lower rate of 10% without indexation, making them more tax-efficient than interest income from bank deposits, which is taxed at the investor’s slab rate.

- Flexible Investment Options: Mutual Funds SIPs offer a range of investment options catering to different risk profiles and investment objectives. Investors can choose from equity, debt, or hybrid funds based on their risk appetite and return expectations.

- Liquidity and Convenience: Mutual Funds SIPs offer liquidity, allowing investors to redeem their investments partially or fully as per their financial needs. Additionally, SIPs offer the convenience of automated investments, eliminating the need for frequent manual intervention.

5. The Power of Compounding:

Compounding is the process whereby the returns generated from an investment are reinvested to generate further returns. Over time, compounding has a snowball effect, exponentially increasing the value of an investment. Here’s how compounding works in Mutual Funds SIPs:

- Regular Contributions: Through regular contributions to a Mutual Funds SIP, investors continue to invest a fixed amount at regular intervals, regardless of market conditions.

- Reinvestment of Returns: The returns generated from these investments are reinvested back into the scheme, leading to the accumulation of additional units.

- Increasing Base: As the base investment grows over time due to regular contributions and reinvestment of returns, the absolute returns generated also increase, resulting in higher overall wealth accumulation.

- Long-term Horizon: The longer the investment horizon, the more pronounced the effect of compounding. By staying invested for the long term, investors can harness the full potential of compounding and significantly enhance their wealth accumulation.

Conclusion:

Mutual Funds Sips offer investors a simple, affordable, and effective way to build wealth, beat inflation, and achieve their long-term financial goals. By investing regularly in diversified portfolios of equities, debt, or a mix of both, investors can potentially generate superior returns over the long term. With the power of compounding working in their favor, investors can harness the full potential of Mutual Funds SIPs and create wealth that helps them secure their financial future. However, it’s essential to consult with a financial advisor and choose SIPs that align with your risk profile, investment objectives, and time horizon to make informed investment decisions.

Start your free Mutual Funds Account today, Call 9480240513

Mutual fund investments are subject to market risks, read all scheme-related documents carefully.